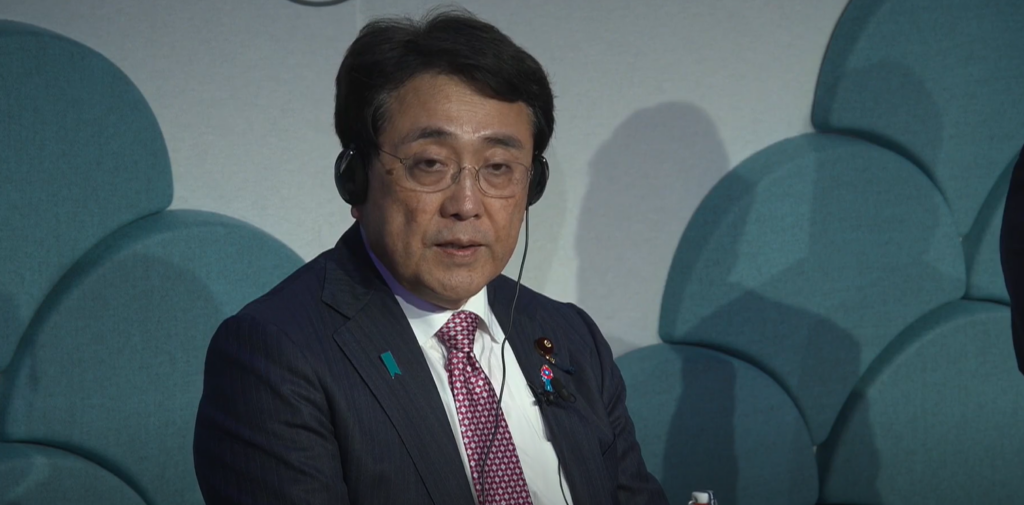

DUBAI: Japan’s Economic Revitalization Minister, AKAZAWA Ryosei told the World Economic Forum on Tuesday that although the Japanese government is not confident that they are out of deflation yet, the future of the Japanese economy is going to be positive.

Speaking at a panel titled ‘Japan Navigates Uncertainty’ in Davos, the minister reflected on the economy during different time periods, starting with former Prime Minister ABE Shinzo.

“With Abenomics (the economic policies led by Abe), we were very bold and we had fiscal and monetary policies. We did some growth regulations and deregulations. We didn’t have much appreciation of the yen at that time,” he said.

“With Prime Minister KISHIDA Fumio—he mentioned the new capitalism and he actually encouraged companies to invest in people, which had been cut in previous times. So in that respect, the economy is going to be positive. Now we are in the time,” he added.

The minister also shared that the nominal GDP exceeded 600 trillion yen and the wages have reached a 33-year high. “The companies are going to invest the assets that they saved, so now we are going to move the economy to a growth economy.”

Even though the economy is shifting towards a growth mindset, the minister shared that he is not confident that Japan is out of deflation. “We are at the crossroads,” he said. “In the past, the Bank of Japan did their monetary regulation and then they went back to deflation. It happened twice. I think once we have announced we have moved from deflation, the economy has to grow. With three decades of deflation, we need to move out of it without going back.”

He added that Japan also needs to focus on managing natural disasters, saying crisis management is important to strengthening the trade power that Japan has. “We have to be aware of (natural disasters) and prepare. (Also) social security has to be sustainable. With all these things combined, we have to create a new Japan. We have to have good crisis management.”

In terms of new technologies that Japan is investing in, Akazawa shared that he would like to expand semiconductors. “In Hokkaido, we have a new company for nano. The number one semiconductor company, TSMC, is going to have factors in Kyushu.”

“Semiconduators are sort of the key to reviving the local economy and also accelerating the competitiveness of Japanese companies in the world. Not only that, but we would like to be innovative in local areas (like) startups.”

He stressed that these economic expansions should happen in local areas rather than Tokyo, due to the overpopulation of the capital.

“The centralization of Tokyo has been a problem since the Meiji period. We artificially put everything into Tokyo and as a result, it’s being overcrowded. It’s very fragile against natural disasters, and the commute time is longer so it’s not easy to live in. In this respect, we have to artificially fragment the populations outside of Tokyo, so this is what we are trying to reinforce,” said Akazawa.

The minister also addressed young people’s concerns towards the economy, adding that he is working on making the minimum wage higher. “The young people in Japan—I don’t think they have ever seen when the economy was good. Now I really want to rectify it but the minimum payment is not very good.”

“From their perspectives, I don’t think they are thinking tomorrow is better than today. If you have economic worries, of course young people can’t have hope… You can live without any worries safely in Japan. I’m in charge of (raising the wages) so this is my mission given by the prime minister,” he added.

Answering a question regarding immigration policies and their impact on the economy, the minister said that Japan might not be an attractive place for foreigners due to the weakened yen.

“What I think is that when (foreigners) come to Japan, because of the depreciation of yen, they can’t send money back to their home countries. For non-Japanese people, Japan may not be an attractive country and that’s my concern. I would like to have an environment for people coming and working in Japan to be better,” he said.

“We would like foreigners to come in as much as possible. On the other hand, how much demand there will be (cannot be determined). Each industry has its own shortage. We have to have a cap in that and the people coming in,” he added.

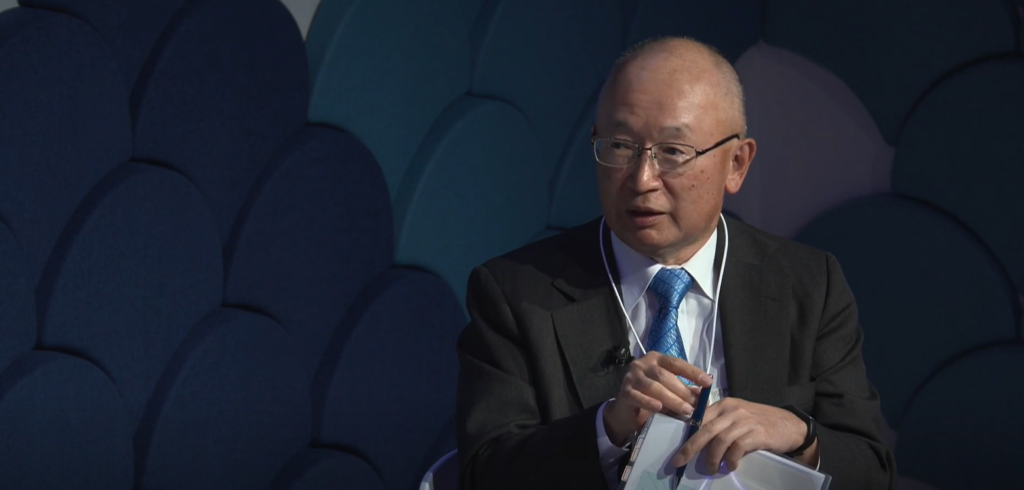

Takeshi Hashimoto, Chief Executive Officer of Mitsui O.S.K. Lines, shared the panel with the minister. Speaking about global trade, he said that that state of it is ‘flexible’ despite Donald Trump, President of the United States, imposing tariffs.

“I’m still quite optimistic about the growth of global trade. Even during the previous Trump administration, there was some tension between US and China, however…China exported many things to Asian countries and Asian countries exported so many things to the US so the total volume of the global rate did not decline,” he said.

While Trump has mainly talked about imposing tariffs on Mexico and Canada, he has also discussed imposing them on Japan and China. Minister Akazawa said measurements should be discussed with the American president.

“How they (the American government) are going to do tariffs is not being expressed,” the minister shared. “However, in the last five years, Japan has been a top investor in America. We are bringing in a lot of factories to many parts of the US. (Trump) may say something to Japan but the amount of investment and contributions we are doing (is big). We are doing a lot of preparations if a trade war happens between the US and China.”

“The important thing is we have a win-win relationship that we built. We are one of the world’s top investors (to the US). This is a very important bilateral relationship. Japan is a great opportunity for world investment. Trade is very practical… We would like Trump to understand that. For tariff measures, we would like to discuss (a framework). We will continue to contribute to that framework.”

Commenting further on Japan’s relationship with China, Mitsui’s CEO said while Japan is investing largely in China, they are beginning to gradually expand worldwide.

“There are so many Japanese companies invested in China and that is because actual production is happening there,” he said.

“We can’t stop immediately. Instead of concentrating on China too much, we are expanding business in India, Asian countries, or African countries. But still, China is the world’s largest producer of iron, steel, and cement,” he added.

Hashimoto stressed that Japan must be sensible when it comes to its economic relations with China. “We have to be careful of the geopolitical tension, and especially with other countries like Russia or North Korea. It’s not an easy choice. We have to continue our business carefully while understanding what is going on in global politics.”

Sharing the panel with the Japanese officials are Milojko Spajić, Prime Minister of Montenegro, and Busi Mabuza, Chairperson at the Industrial Development Corporation of South Africa. The former speaks fluent Japanese, as he previously lived in Osaka.

“Japan has been, for many decades, an island of certainty, stability, and safety throughout this period of difficult time,” the Montenegro Prime Minister said. “Japan has been a very reliable, stable, and predictable friend to Europe. After decades of deflation, we are seeing the proofs of inflation picking up in a way that hasn’t been seen since the 1980s.”

“You can see a mentality shift happening in Japan, where investors and big corporations are not going to hoard the cash anymore. They are going to be more aggressive in investing. The shareholders are going to require not to be bought back. The Japanese economy is actually very significant now.”

The South African chairperson echoed Montenegro’s Prime Minister statements. “Japan is an island of stability and peace. Japanese companies that have been invested in South Africa have brought those centered values to the country. Japanese (companies) seem to take a long-term view when they look for investment opportunities,” Mabuza said, adding that Japan is a critical member of the G20.

“Japan’s investments (in South Africa) have added value on the ground rather than an extractive approach. I think we need more of that. One of the most favorite vehicles in South Africa is Toyota. There is significant production capacity in Toyota vehicles in South Africa.”

The panel was moderated by Financial Times’ chief foreign affairs columnist.