- ARAB NEWS

- 02 Jul 2025

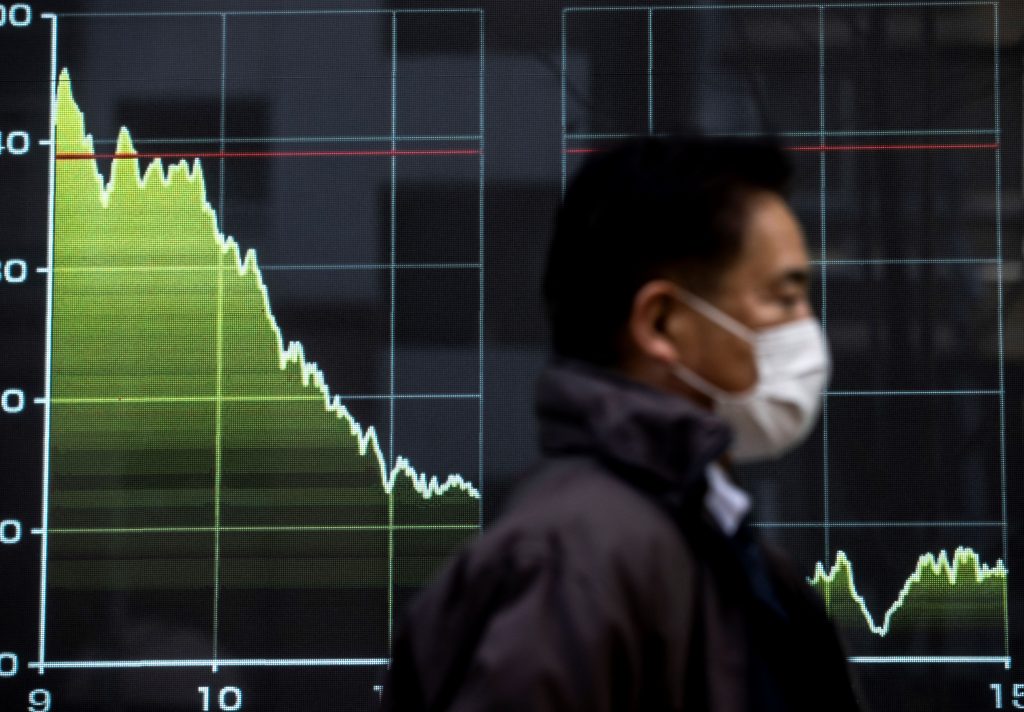

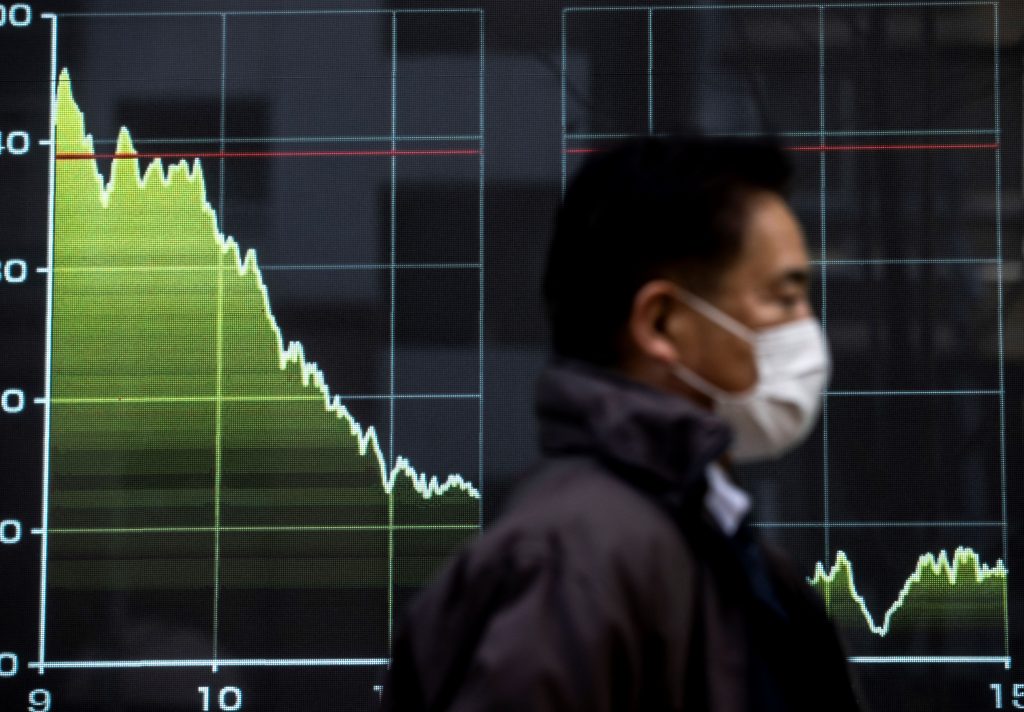

NEW YORK: Japanese banks are unlikely to face what happened to Silicon Valley Bank in the United States, despite rising interest rates, The Wall Street Journal said in its online edition Monday.

The collapse of SVB “has put a spotlight on losses in banks’ bond portfolios caused by rapidly rising interest rates in the U.S. and elsewhere,” the U.S. business daily said. “Some Japanese banks are feeling the pain too,” the paper said, citing unrealized losses on foreign bonds held by Norinchukin Bank, the central organization for agricultural, forestry and fishery cooperatives in Japan, and Japan Post Bank.

But Japanese financial institutions “will likely avoid similar fallout despite mountainous Treasury (bond) holdings,” the report said.

The report noted that SVB suffered from not only unrealized losses on its bond portfolios but also “its concentrated depositor base: heavy on tech companies, with big deposit amounts way over deposit insurance limits.”

Due to a downturn in the technology industry, previously high-rolling companies and startups in the sector “were suddenly not depositing much cash anymore,” the report said. They instead “fled the bank in a hurry when hints of mark-to-market losses began to emerge from SVB,” according to the report. This in turn forced the bank to “sell more bonds at a loss to try to meet withdrawals,” it said.

But the funding structure “should be more stable for most of the Japanese banks,” the paper said, referring to 120 million deposit accounts held by Japan Post Bank. Norinchukin’s deposit base is mostly from the agricultural and fishery industries, which are “far less volatile than the hard-charging, excess-prone U.S. tech sector,” the report also said.

JIJI Press