- ARAB NEWS

- 04 Jul 2025

Having succeeded in establishing itself as a capable host for international events such as the G20 Summit in 2020, Riyadh will be hosting the Future Minerals Forum this month with over 2,000 attendees, including ministers from the Kingdom and abroad as well as experts and dignitaries from the mineral sector.

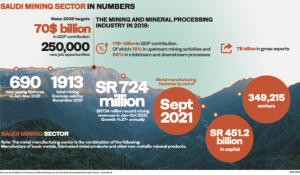

The Future Minerals Forum underscores the Kingdom’s global ambition to advance the mining goals of Saudi Arabia. According to the forum organizers, there is an estimated $1.3 trillion in untapped mining potential in Saudi Arabia alone. The groundwork for potential local and international investors has been made easier as around 700,000 square kilometers of geophysical and geochemical surveys of the Saudi mineral landscape has been carried out, considered among the largest in the world.

This first government-led initiative is a welcome step, as the mining sector was traditionally assigned a lower priority in both government planning and public expenditure in the 1970s and 1980s, compared with the traditional hydrocarbon sector.

Given the importance of diversifying the Saudi gross domestic product, the mineral sector has gradually risen in importance as evidenced by the privatization of the state-owned mining company Maaden in 2008, with its restructuring and focus on separate gold, bauxite, phosphate, aluminum and mineral sections.

Maaden aspires to become a premier global producer and marketer of phosphate fertilizers. It established joint ventures with both SABIC in Saudi Arabia and international joint ventures like ALCOA, the world leader in the production and management of primary aluminum.

Gold mining is now one of its priorities. It may come as a surprise to many that Saudi Arabia is home to a wide and rich resource base of mineral deposits, including rare earth, diamonds, copper and lithium, the largest in the Gulf region.

To enhance the value chain of the mining sector, the Saudi government is moving away from the old policy of mere mineral extraction to a new policy of creating a well-integrated mining industry over the coming decade. Accordingly, the sector’s operating framework has been re-assessed to align industry policies with international practices.

The key point of the mining code ratification was ensuring that the Kingdom was competitive with other international mining investment regimes.

Sovereign ownership of natural resources and how they are exploited by foreigners has always been a politically sensitive issue. According to Article 14 of the Saudi Basic Governing Law, all resources that lie under or over the ground within the perimeter of the land or offshore of the Kingdom belong to the state.

The problem for the mining industry in Saudi Arabia was how to reconcile this with the international practice of “licensing concessions” to the private sector. The amendments submitted before the Council of Ministers allowed for such licenses to be granted by the Ministry of Petroleum and Minerals. The issue of sovereign risk participation will be raised at the forum.

Key among Saudi mineral resource exploitation was addressing the legal framework by modernizing the mining code, formulating the Saudi geological survey, and formulating a comprehensive strategy for the sector.

A new mineral investment law in 2004 included the principle of “first come, first served,” no limit on the number of licenses, the removal of advance payment requirements, the introduction of investment incentives, and a total tax liability not exceeding 25 percent of profits.

Saudi Arabia’s “hidden” treasures could ensure that mining could be playing a role in the Saudi economy like the one oil played decades ago.

Dr. Mohamed Ramady

Given the large landmass of the Kingdom and the diverse location of mineral resources, the importance of establishing a countrywide rail network to service the mineral sector is an essential element for success and to also link industrial exploration hubs.

The objective is clear and will be debated at the planned forum, essentially to broaden the economic base of the Kingdom and create new economic opportunities through high value jobs.

Previous experiences from established mining countries proved that every dollar spent on mining generated a net return of between $8 and $10 to the national economy, besides easing a country’s balance of import payments for minerals.

According to the Future Minerals Forum, the world needs to increase mineral output seven-fold to satisfy global demand for the inputs required to fuel the circular carbon economy but bearing in mind the environmental concerns in this sector, something that is being addressed at the forum.

The experience of countries with a rich mining history such as Canada, Australia, South Africa and Chile has been noted, especially in establishing mineral end-user industries instead of mere conventional mineral exports that do not add economic value or create jobs.

One critical mineral example is rare earth, which is of great importance to the microchip conductor industry and a source of potential friction between global superpowers in accessing this raw material, as China has some of the world’s largest reserves.

Foreign participation in the Saudi mineral sector is essential due to the relatively young Saudi experience in this field, in contrast to the more established petroleum sector where Saudi technical skills exist in all working areas. This is clearly observed by the large international participation at the forum.

Planning for a grand mineral vision is one thing, but implementing it with a skilled national labor force is another. Saudi universities have to re-invigorate their existing geology, mining and minerals curriculum, or establish new departments in order to meet future graduate demand in this sector.

This will not be an easy task, given a recent survey of young Saudis who expressed their preference in working in media, tourism and entertainment, shying away from the previous prestige and sought-after employment in the hydrocarbon sector.

Given that a career in mining and minerals is seen as possibly less glamorous and more dangerous compared to its peers in petroleum and chemical engineering, a lot of effort has to be made to ensure that a career in the minerals sector can also be rewarding, safe and glamorous. Advanced mining drilling technology has made the industry safer compared to decades ago, but mining still attracts the more hardened and free-spirited workers who like operating in harsh work environments.

In conclusion, Saudi Arabia’s “hidden” treasures could ensure that mining could be playing a role in the Saudi economy like the one oil played decades ago.

• Dr. Mohamed Ramady is a former senior banker and professor of finance and economics at King Fahd University of Petroleum and Minerals, Dhahran.