- ARAB NEWS

- 02 Jul 2025

It has been a tumultuous few weeks in the UK, with three prime ministers in two months, countless ministerial resignations and the loss of a beloved monarch. Amid rising inflation and interest rates, the effects of COVID-19 and Brexit are taking a toll on businesses, challenging their ability to stay afloat, while people tighten their belts and limit spending in the face of a cost-of-living crisis.

At the same time, a labor shortage has left firms struggling to find employees to fill empty posts, leading to a U-turn on immigration, as the country realizes it needs immigrant workers to maintain basic services.

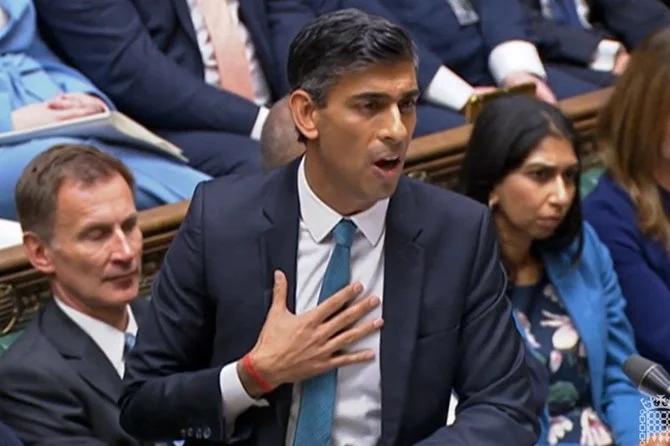

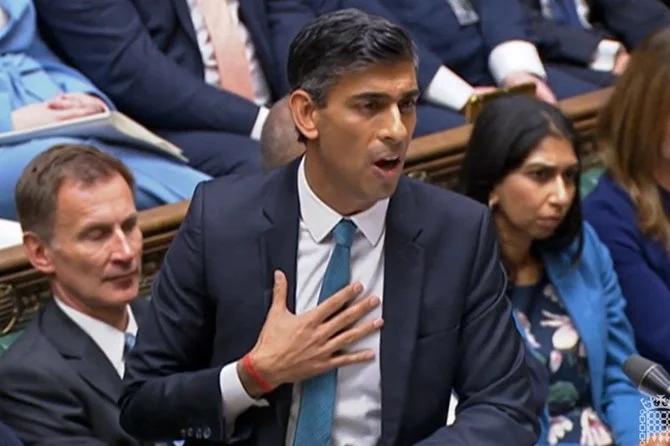

Can Rishi Sunak, the new UK prime minister, bring some stability? His previous role as chancellor of the exchequer, as well as a financial analyst for Goldman Sachs and hedge fund partner, appear to be giving the markets confidence, with the pound rising to 1.15 against the dollar, its highest level in over a month.

Surely, stability is the best route to regaining international investment? Sunak’s experience as finance minister — he introduced the furlough scheme to prevent severe unemployment and business collapse during the pandemic — and his steady assuredness seem just what the country needs. Someone who can lead, without buffoonery and risky chance-taking. It will not be an easy ride regardless of who is in charge. There is a large deficit to be made up and Sunak is opposed to the country borrowing more, which means the money has to come from the people or from outside investment; most likely both.

Does this mean Sunak will make an effort to build on UK-Middle East relations? With wealthy Russian oligarchs out of the picture, he needs to bring in economic interest from elsewhere. The US economic relationship with the Gulf is still on shaky ground after the Biden administration refused to continue maintenance of Saudi military aircraft in Yemen to defend against Iranian attacks, and the Kingdom steadfastly stuck with OPEC’s decision to cut oil production, despite Washington’s requests to increase their yield.

Indeed, OPEC announced the decision to cut production by a further 2 million barrels per day in order to stabilize price volatility. With the OECD’s oil stocks 8 percent below its five-year average and energy prices rising due to the invasion of Ukraine, Sunak’s ability to deal with Saudi Arabia and OPEC will be vital.

With the UK’s economy having taken a beating, someone with a firm financial understanding is what is needed

Bashayer Al-Majed

Additionally, if Ukraine’s intelligence reports are true and Iran is supplying Russia with Shahed-136 “kamikaze” drones and other military equipment, building a stronger relationship with the Kingdom and the Middle East seems a smart move. Back in August, Sunak said, in relation to Iran: “We urgently need a new, strengthened deal and much tougher sanctions, and if we can’t get results then we have to start asking whether the JCPOA is at a dead end.”

The JCPOA was signed in 2015, with Iran agreeing to reduce its stockpile of uranium and limit its nuclear facilities, but Sunak believes sanctions beyond nuclear should be introduced. UK support for further pressure on Iran would certainly be well received in Saudi Arabia.

Sunak has been criticized for taking a hard line on religious extremism, where it is linked to terrorism, but all nations would surely agree that terrorism is good for no one. The UK’s new leader had vowed to more strongly implement his government’s counter-extremism strategy, Prevent, aimed at preventing radicalization of vulnerable youngsters who may be targeted by terrorist organizations. Good in theory, and it does indeed claim to have prevented 100 radicalized children being sent to areas of conflict and supported over 2,000 other vulnerable individuals.

However, the strategy has received criticism from Muslim societies and human rights organizations for profiling and stigmatizing Muslims. It is likely that Sunak will support pressure on some Arab countries to tighten financial security in order to supress any chance of terrorist organizations laundering money.

It seems that Sunak, with his background in economics, will follow wherever there seems to be good financial sense. It will be interesting to see how this translates into the world of international politics and diplomacy. With all the global instability, food and fuel prices rising, and new global alliances potentially being formed, having a good political understanding could be key. But, for now, with the UK’s economy having taken a beating, someone with a firm financial understanding is what is needed; Britain will be hoping that Rishi Sunak can steer the country out of the storm and keep an even keel.