- ARAB NEWS

- 06 Jul 2025

RIYADH: 2021 has been a year of recovery for the dividends Saudi Arabia’s listed firms paid out to investors, as the economy gained traction after the outbreak COVID-19 pandemic last March.

Although it remains to be seen how the omicron variant will weigh on the bounce business experienced earlier this year after vaccination roll-outs and the easing of lockdown restrictions.

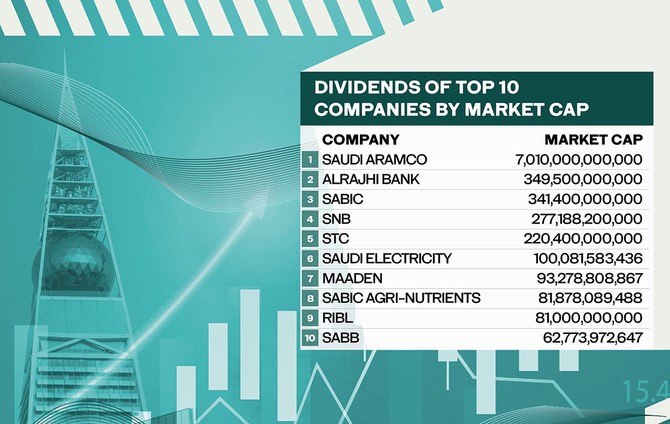

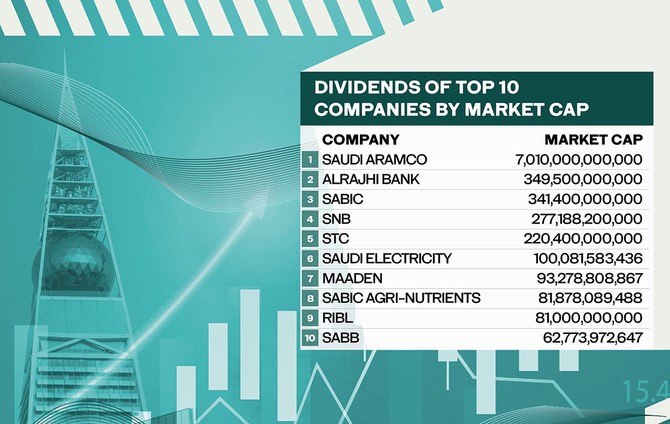

However, the top 10 players on the Saudi bourse – which overall is valued at over $2 trillion (SR7.5 trillion) – paid out stable to higher dividends in 2021, attracting investors who want a reliable income amid global uncertainties brought by the pandemic.

The largest 10 firms are made up of four energy and material giants, four banks, a utility provider, and one telecom company, which operate relatively steadily and have a collective market capitalization that tops $16 billion.

The Kingdom’s oil giant Aramco dominates the bourse, compromising over SR7 trillion in market value. Aramco’s dividend payout was unchanged from a year earlier, and paid each shareholder SR1.05 per share for the first nine months of 2021. This brought the trailing dividend yield to nearly 4 percent on a share price of SR35.

Fueled by rebounding crude prices, the oil giant’s net profit more than doubled during the first nine months compared to the same period a year ago, reaching as much as SR279 billion.

Chemicals manufacturer Saudi Basic Industries Corp., known as SABIC, and worth above SR341 billion, said it would pay out SR6.75 billion — SR2.25 per share — as a dividend to shareholders in the second half of 2021.

The industrial firm’s recommendation brings the annual dividend payout per share to SR4, from SR3 in 2020. The hike followed strong financial results for the first nine months of 2021, which saw SABIC swing to a profit of SR18.1 billion from a SR2. 6 billion loss a year ago — mainly driven by income from joint ventures.

The Kingdom’s banking leaders — Al Rajhi Bank, Saudi National Bank, Riyad Bank, and the Saudi British Bank — all declared higher dividend payments in the year to date.

Al Rajhi Bank, one of the 15 largest banks globally by market value, paid out SR3.5 billion — or SR1.4 per share — as a dividend for the first half of 2021, in contrast to just SR1 per share for the entire 2020. This came as it announced a 44 percent jump in net profits to SR10.73 billion for the nine months to Sept. 30, 2021.

Saudi’s second-largest bank, Saudi National Bank distributed SR0.65 per share for the first half of this year. This compared to a net annual dividend per share of SR0.8 for the whole of 2020, meaning that its half-year payout lifted 62.5 percent year-on-year.

Saudi Telecom Co., or stc, paid out quarterly dividends totaling SR3 per share for the first three quarters of 2021, matching last year’s rate. This resulted in a 3.6 percent trailing dividend yield on a stock price of SR110.8.

Six-year data reported by the telecom operator revealed a stable trend in terms of the net annual dividend per share, fluctuating between SR4 and SR6 since 2016.

Since 2005, Saudi Electricity Co. has provided a safe dividend haven for shareholders, offering regular annual payouts of SR0.7 per share even amid high volatility. In 2021, the dividend yield came in at 3 percent on a share price of SR110.

The Gulf’s largest miner Arabian Mining Co., known as Ma’aden, has withheld dividends to finance growth since listing in 2008. The company posted a profit of SR3.14 billion in the first nine months of this year, swinging from a net loss of SR781 million in the year-ago period.

The eighth biggest listed firm in the Kingdom SABIC Agri-Nutrients, yielded 2.5 percent on a stock price of SR172, and offered its highest dividend policy since 2015 this year. The petrochemical firm’s payout jumped 113 percent year-on-year to hit SR4.25 per share.

Despite moderate dividend yields, most of these big companies have enjoyed long records of consistent growth and steady payments — a good bet for risk-averse investors.