- ARAB NEWS

- 29 Apr 2024

Arab News

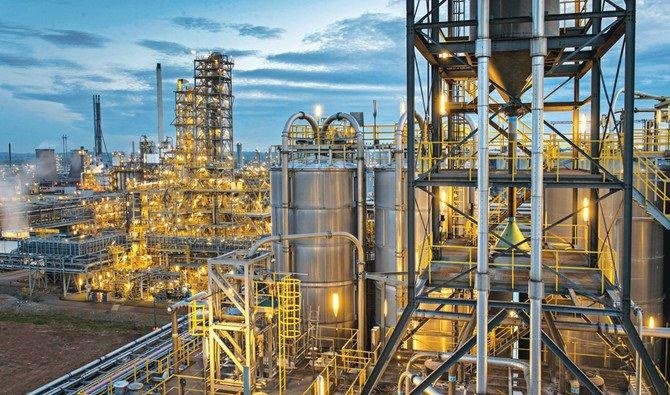

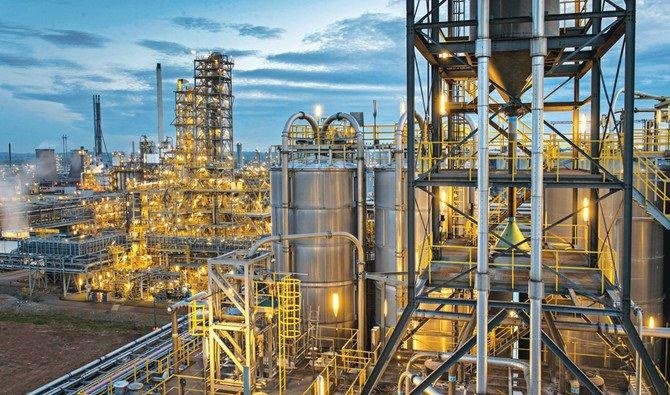

RIYADH: Saudi Basic Industries Corp. (SABIC) reported a surge in second-quarter profit as it sold more chemicals at higher prices than the previous quarter amid an increase in crude prices.

Net profit jumped 57 percent to a 10-year high of SR7.64 billion ($2.04 billion) in the three months to the end of June as revenue rose 13 percent to SR42.42 billion, SABIC said in a filing to the Tadawul stock exchange.

The Middle East’s largest petrochemicals producer posted a SR12.51 billion first-half profit on sales of SR79.95 billion, compared with a loss of SR3.27 billion on sales of SR54.81 billion in the same period last year.

Selling prices increased by 10 percent in the second quarter compared with the first three months of the year, while sales volumes rose 3 percent. Over the first half, sales prices were 48 percent higher and volumes were 2 percent lower compared with last year.

“SABIC’s financial performance in the second quarter was strong – continuing the margin improvement seen during the first quarter of 2021,” Yousef Abdullah Al-Benyan, vice chairman and CEO of SABIC, said in a statement to the Tadawul. “This was driven by higher sales volumes and prices, supported by a rise in oil prices and a healthy supply and demand balance for most of our key products as the global economy continued its path to recovery.”

SABIC achieved $230 million of synergies with Saudi Aramco since June 2020 when Aramco acquired a 70 percent stake in SABIC, driven by combining their purchasing power and sharing warehousing and logistics facilites.

In the second half of 2021, SABIC expects demand will continue to be strong in line with the recovery of the global economy. Margins will moderate, but remain healthy as oil prices and feedstock costs remain elevated while existing supply constraints ease and new supply capacity comes on line, it said in the filing.

SABIC will be targeting markets for its products in the US, China and Africa as they represent promising growth opportunities for its main sectorsm Al-Benyan said in a press conference after the earnings, Arabiya reported.

The company has no plans to issue bonds ot other debt instruments but financial evaluation of the markets and the company’s position will continue, he said.