- ARAB NEWS

- 14 Jul 2025

EU foreign policy chief Josep Borrell on Saturday said that the Lebanese leaders were to blame for the crises gripping their country, and threatened to impose sanctions on those who continue to obstruct the formation of a new government. Meanwhile, earlier this month, the World Bank issued another warning about the impending economic collapse of Lebanon, stressing that its economic and financial crisis is likely to rank in the Top 10, possibly Top 3, most severe episodes globally since the mid-19th century.

In fact, Lebanon has been gripped by a combined political and economic crisis since at least October 2019, when Lebanese youths took to the streets to protest against the economic recession and Iran’s meddling in Lebanon’s affairs. The protests forced the resignation of then-Prime Minister Saad Hariri.

The twin crises intensified last summer following the Beirut port blast that killed hundreds and injured thousands of innocent civilians, destroyed many homes and toppled the government of Prime Minister Hassan Diab. Since then, Lebanon has not been able to form a new government to replace Diab’s and the economic crisis has reached boiling point.

Lebanon’s mishandling of the coronavirus pandemic has wreaked havoc with the health and livelihoods of its citizens and accelerated its slide toward chaos.

Lebanon’s multiple crises are now coming to boiling point and threatening to unleash unprecedented chaos in the already troubled country. Last Tuesday, the Lebanese pound hit a record low of 15,550 to the dollar in unofficial exchanges — a tenfold increase on the official rate of 1,507, which has been in place since 1997. It continued in effect until September 2019, when the banking sector practically collapsed. Since then, while maintaining the official peg to the dollar, the pound’s rate of exchange has declined dramatically, with several unofficial and semi-official rates operating at the same time.

Lebanon’s public debt has exceeded 170 percent of gross domestic product (GDP), the highest ratio in its history and among the highest globally. The country defaulted on paying back debt obligations for the first time in March 2020, while talks aimed at reaching an agreement with the International Monetary Fund (IMF) on a bailout package stopped last year, and corruption accusations leveled at Lebanon’s top banking officials have further eroded trust in Lebanon’s monetary and financial system both locally and internationally.

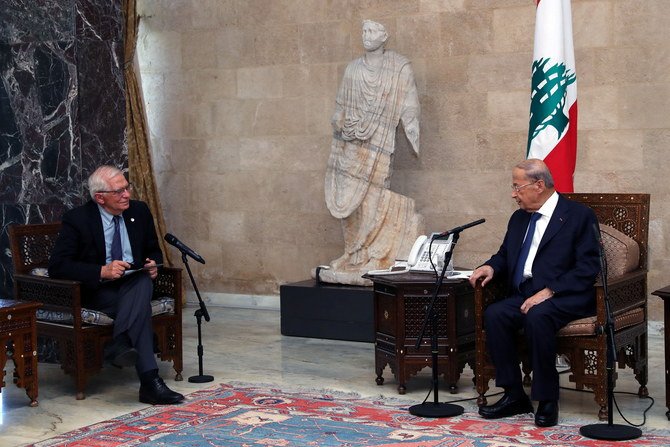

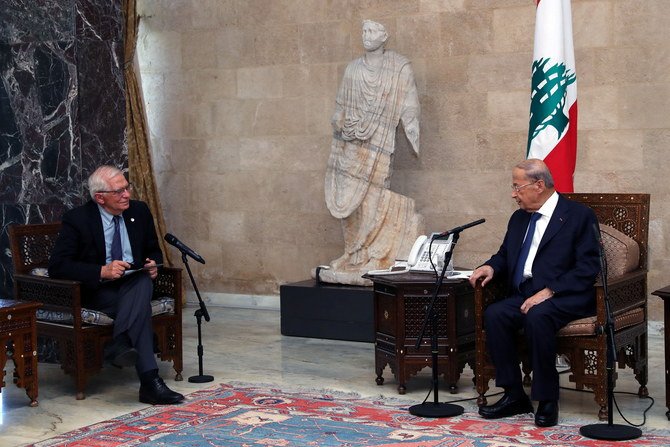

Borrell’s comments, which were made at the presidential palace after he met with President Michel Aoun, came amid reports in the Lebanese media that France and the EU are putting together proposals for possible travel bans and asset freezes on some Lebanese politicians. Borrell urged Lebanon to reach a deal with the IMF, saying: “We cannot understand that nine months after the resignation of a prime minister, there is still no government in Lebanon… Only an urgent agreement with the International Monetary Fund will rescue the country from a financial collapse… There is no time to waste. You are at the edge of the financial collapse.”

Borrell revealed that the Council of the European Union had been weighing up other options, including targeted sanctions. He rejected claims by some Lebanese politicians that refugees were the cause of the crisis. “It is not fair to say that the crisis in Lebanon comes from the presence of refugees,” he said.

In a June 1 report, the World Bank lamented the “continuous policy inaction and the absence of a fully functioning executive authority,” adding that, for the past 18 months, “Lebanon has been facing compounded challenges: Its largest peace-time economic and financial crisis, COVID-19 and the Port of Beirut explosion.” It described the policy responses to these challenges by Lebanon’s leadership as “highly inadequate.” It estimated that real GDP contracted by 7 percent in 2019 and 20 percent in 2020, along with an expected 10 percent in 2021, bucking the international trend of recovery during this year. It reported a “brutal contraction” of GDP from $55 billion in 2018 to $33 billion in 2020 — a drop of 40 percent.

The World Bank warned that “Lebanon faces a dangerous depletion of resources, including human capital, and high-skilled labor is increasingly likely to take up potential opportunities abroad, constituting a permanent social and economic loss for the country.” It expected further deterioration in basic services, including electricity, water supply, sanitation and education, as well as rising unemployment and poverty rates, with more than half the population below the national poverty line.

Many see the roots of Lebanon’s crises in decades of corruption and sectarian-based division among its leaders. However, the recent political and economic mismanagement by the ruling coalition is unprecedented. The coalition is dominated by Hezbollah and supported by the Free Patriotic Movement, a political group headed by Aoun’s son-in-law Gebran Bassil.

Multiple crises are now coming to boiling point and threatening to unleash unprecedented chaos.

Dr. Abdel Aziz Aluwaisheg

In addition to corruption and mismanagement, Lebanon’s acquiescence to Hezbollah’s participation in the Syrian civil war on Iran’s side has alienated many of its traditional partners, including the US, Europe and the Gulf Cooperation Council countries. Failing to live up to its financial obligations and its defiance of international institutions have left it with very few friends.

This crisis is the biggest threat to Lebanon’s stability since at least the 1975-1990 civil war or, according to the World Bank, since the mid-19th century, when it faced an earlier civil war.

With no other options left, Lebanon should take very seriously the exhortations and warnings of the EU foreign policy chief and the World Bank, who are not usually given to unfounded exaggerations.