Oil prices continued to fall for a fifth week in a row and reached their lowest level in a year.

Brent crude dropped to $54.47 per barrel while WTI retreated to $50.32.

The global oil market now finds itself trapped between two viruses.

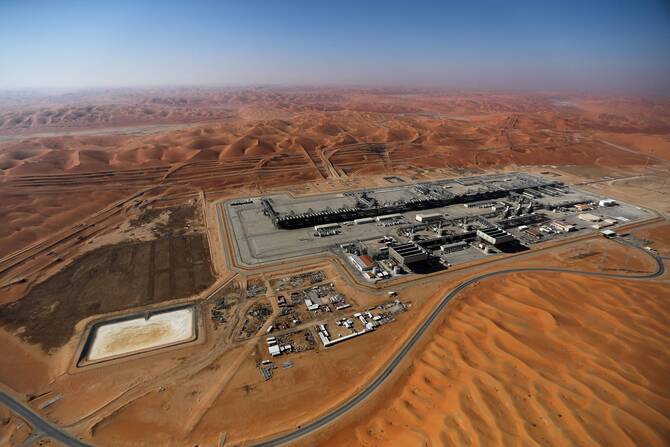

The deadly coronavirus outbreak in China has hurt short-term oil market demand and at the same time cyber-attack attempts on Saudi Aramco have also increased.

One threatens supply, the other demand. However, the downward trend in oil prices is still ultimately about macroeconomics.

Despite such headwinds, the global oil market remains largely in balance as a result of the fourth year of efforts by OPEC+ to ensure it is so — even with a surge of oil supplies from unconventional resources.

Expectations of slowing growth in the global economy in the second half of 2020 should result in slightly lower crude oil demand.

OPEC efforts to curb production still need to be unanimously extended, especially after Chinese oil demand dropped by about 3 million barrels a day, which is about a fifth of total Chinese refining capacity. Demand could fall further as storage capacity gradually fills, causing delays in discharging cargoes and leaving refiners, already under pressure from weak margins, facing hefty demurrage charges to compensate shipowners for delays.

The situation has also discounted crude oil barrels in the spot physical market.

For instance, the spot price premiums for Russian ESPO crude oil cargoes, the only barrels that arrive in China through pipeline, as the most popular crude grade for the independent Shandong “teapot” refineries have hit their lowest in five months.

The biggest impact was felt in China’s eastern Shandong province, which accounts for almost 20 percent of total Chinese crude oil imports. Here refining utilisation rates have fallen by half.

Such shrinking demand and weakening refining capacity from China has created fallout in the shipping industry as charterers are forced to pay penalty fees to ship owners for delays in unloading cargoes. This has caused tanker rates to tumble.